Partial Reopening of Turkey’s Wheat Import Restrictions and the Impact on Russian Wheat Prices

Turkey’s wheat import ban, introduced on June 21, 2024, has left a profound impact on the nation’s flour industry, causing significant drops in export levels. However, recent updates suggest that a partial reopening through a quota system will begin on October 15, 2024, allowing flour producers to regain some of their competitive standing. Meanwhile, these restrictions have also influenced Russia’s wheat prices, creating further market fluctuations.

The June Wheat Import Ban and Its Impact on Flour Producers

On June 21, 2024, Turkey imposed a ban on wheat imports as part of broader external trade measures. This ban posed a serious challenge for flour producers, cutting off access to imported wheat, which is essential for maintaining production levels. As a result, Turkish producers had to rely solely on domestically sourced wheat, which led to increased costs and reduced production capacity.

Export Decline and Industry Struggles

The export performance of Turkish flour producers suffered a significant blow. From June to August, flour exports dropped by 35-45% compared to the same period last year, with declines of 30% in June and July, and 40% in August. This sharp fall in exports highlighted the critical role that wheat imports play in maintaining the competitiveness of Turkey’s flour industry in the global market.

Russian Wheat Prices: A Critical Factor in the Equation

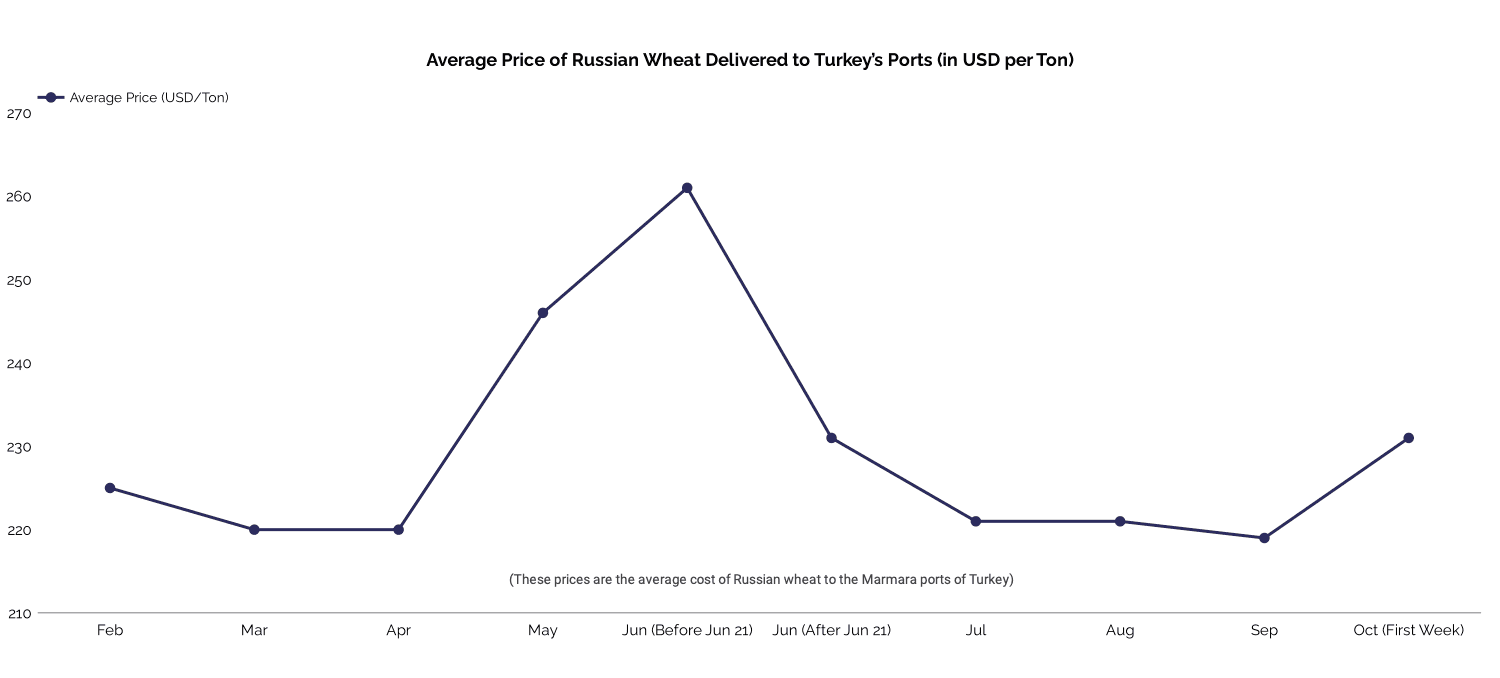

Russia, one of the world’s largest wheat exporters, saw its wheat prices fluctuate during Turkey’s import restrictions. Russian wheat is a key source for Turkish flour producers, and the trade dynamics between the two countries have a direct impact on flour production costs. Below is a table showing the average monthly prices for Russian wheat delivered to Turkish ports in 2024, reflecting significant shifts during this period.

The graph shows a rise in prices before June 21, 2024, as demand increased due to concerns about the impending ban. After the ban, prices dropped significantly, as Turkey, a major buyer, exited the market. However, prices began to climb again in October, as anticipation grew around the upcoming partial reopening of wheat imports.

Price Trends and Future Expectations

Before the ban, the average price of Russian wheat had been rising, peaking at $260 per ton in early June. Following the implementation of the import ban, the average price dropped sharply to $230 per ton in late June and stabilized around $220 per ton in July and August. As October approached, average prices began to increase again, reaching $230 per ton, driven by speculation about the market reopening. The wheat prices, which started rising before the partial reopening decision, are now a subject of interest as the market awaits how they will evolve following the partial reopening announcement made over the weekend.

Partial Reopening Through a Quota System

Starting from October 15, 2024, the Turkish government plans to reopen wheat imports under a quota system. According to the Turkish Flour Industrialists Federation (TUSAF), flour producers will be able to source wheat through a combination of domestic and international avenues. They must first obtain wheat from local sources before they can import a limited percentage under the quota system.

Sourcing Wheat Domestically

Producers will be required to obtain at least 85% of their wheat allocation from the Turkish Grain Board (TMO), at special prices designed to be competitive with global market rates. These pricing structures will ensure that flour producers remain competitive internationally, even as they rely on wheat from TMO. The remaining percentage of wheat can be sourced through imports based on the volume of their exports, allowing producers to meet their additional needs.

The goal of this approach is to stabilize the market and provide relief to exporters, helping them maintain their competitiveness despite the restrictions on imports. Additionally, producers may opt to source their entire wheat allocation from TMO, benefiting from the competitive pricing offered.

Challenges and Opportunities Ahead for Turkish Flour Exporters

The partial reopening presents both opportunities and obstacles for flour producers. The ability to import wheat, even at limited levels, is a welcome development for many struggling producers. However, the reliance on domestic wheat and the 85% sourcing requirement may continue to limit production capabilities for some.

Recovery of Export Levels

Producers will need to carefully manage their wheat sourcing strategies to take full advantage of the quota system. By sourcing wheat at competitive domestic prices and supplementing with imports, exporters have the opportunity to regain some of the competitiveness they lost during the ban. The next few months will be crucial in determining whether Turkish flour exports can recover to previous levels.

A Step Toward Stability

The partial reopening of Turkey’s wheat imports marks an important turning point for the country’s flour industry. Although challenges remain, the ability to once again access international wheat markets is a positive development. As domestic wheat pricing schemes are adjusted to support export competitiveness, producers will need to balance domestic and international sourcing effectively. In parallel, the impact of these changes on Russian wheat prices and broader market dynamics will continue to be a critical factor in the months ahead.