Turkey's Flour Production Volume

Turkey's flour industry plays a crucial role in the global market, consistently leading as the world’s top flour exporter. In 2024, Turkey’s flour export volume is projected to reach a record 5.4 million tonnes, maintaining its dominance in the international trade of wheat-based products. The country benefits from a robust infrastructure of modern milling facilities, as well as strategic geographical positioning near major wheat-producing regions like Russia and Ukraine. This proximity, combined with efficient production capacities, allows Turkey to supply significant amounts of flour to markets across the Middle East, Africa, and beyond. The Turkish flour sector is supported by both local wheat production and imported raw materials under the Inward Processing Regime, which helps maintain cost efficiency while boosting export competitiveness. In 2024, wheat production is expected to reach 20 million tonnes, further securing the country’s ability to meet domestic and international demands. With continued investments in milling technology and government support, Turkey remains a key player in global food security, particularly in flour trade.

Turkey's Flour Production Volume Statistics (2024)

In 2024, Turkey remains a global powerhouse in flour production and exports. The country continues to leverage its extensive wheat farming and milling capacity, alongside favorable export markets.

Production Figures

Turkey's wheat harvest for 2024 is projected to be between 22 million and 23 million tons, a slight increase from previous years. This robust wheat supply supports its flourishing flour industry, which has a production capacity of approximately 38 million tons annually across nearly 600 mills

Flour Export Growth

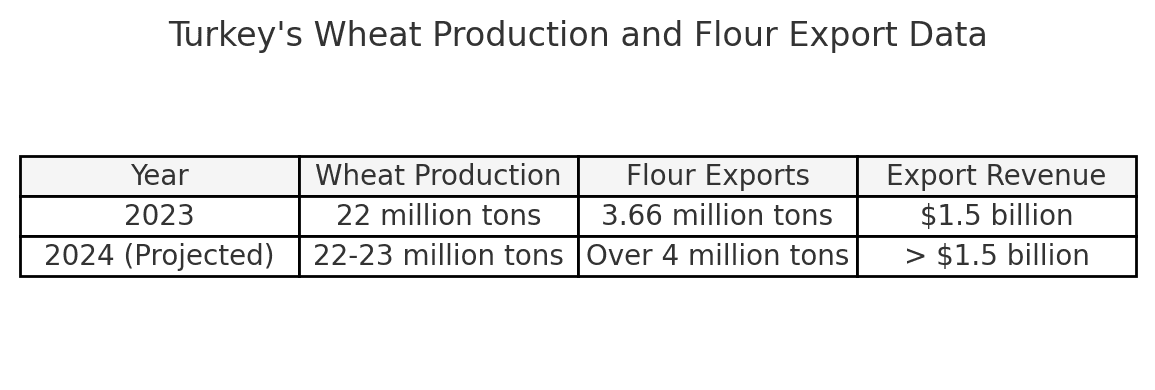

Turkey has maintained its position as the world's largest flour exporter for over a decade. In 2023, it achieved record flour exports of 3.66 million tons, with earnings of $1.5 billion. For 2024, the country aims to exceed this, setting a target of over 4 million tons of flour exports. By March 2024, Turkey had already seen export increases of 22% in January and 60% in February

Breakdown of 2024 Flour Export Targets

Target Export Volume: Over 4 million tons

Key Markets: Near East Asia, Sub-Saharan Africa, and Central Asia

Revenue Goal: Exceed $1.5 billion in exports

Summary Table

Turkey's consistent growth in both production and export volumes has been driven by improvements in milling technologies and expanding global demand. As the country aims to diversify its export destinations and increase domestic wheat output, it is expected to maintain its global leadership in the flour market.

Factors Influencing Flour Production in Turkey

Several internal and external factors contribute to the dynamics of flour production in Turkey, shaping both its capacity and competitive edge in global markets.

1. Agricultural Conditions and Wheat Supply

Climate and Weather: Wheat, the primary raw material for flour production, heavily relies on favorable climatic conditions. Regions such as Southeastern Anatolia, which specializes in durum wheat, benefited from improved rainfall in 2024, boosting production by 10%. However, fluctuations in climate, including droughts, can significantly impact yields and consequently affect flour production volumes.

Government Support for Wheat Farming: The Turkish Grain Board (TMO) plays a key role by setting attractive wheat purchase prices and providing differential payments to support farmers. This ensures a stable supply of wheat for flour production, mitigating risks posed by market volatility.

2. Technological Advancements in Milling

Investment in Modern Mills: Turkey's flour industry has consistently invested in modern milling technologies, enhancing both the quality and quantity of production. Many of the country’s 600 mills are equipped with advanced technology to maximize efficiency and maintain consistent output.

Increased Capacity: Innovations in milling processes have allowed Turkey to expand its production capacity to an estimated 38 million tons annually, positioning the country to meet growing global demand.

3. Export Market Dynamics

Global Demand: Turkey’s flour export success is largely driven by strong demand from regions like Near East Asia, Sub-Saharan Africa, and Central Asia. The expansion of these markets continues to boost production.

Geopolitical Factors: Geopolitical events, such as the ongoing conflict in Ukraine and the resulting disruptions to wheat exports, have led countries to turn to Turkey as a reliable flour supplier. This has increased the demand for Turkish flour, particularly in countries that previously relied on Russia and Ukraine.

4. Government Policies and Trade Regulations

Import Bans and Protectionist Policies: In 2024, the Turkish government introduced temporary bans on wheat imports to protect local farmers from market volatility and ensure stable domestic wheat procurement. Such measures directly impact flour production by ensuring the availability of local raw materials at controlled prices.

Export Incentives: The government also encourages flour exports through policies that enable competitive pricing and strategic trade agreements. These incentives have allowed Turkey to solidify its position as the top global flour exporter.

5. Global Wheat Prices and Supply Chain

Price Volatility: Wheat prices, influenced by global factors like droughts in key producing regions or conflicts affecting grain exports, can significantly impact production costs. Turkish flour producers are often able to absorb some of these price fluctuations due to government interventions, but external factors still pose a challenge.

Logistics and Distribution: Turkey’s strategic geographic location facilitates efficient distribution to Europe, Asia, and Africa. However, logistical challenges, including rising fuel costs and disruptions in global shipping, may affect export timelines and costs.

Turkey's flour industry stands as a global leader, driven by a robust combination of favorable agricultural conditions, advanced milling technologies, and strategic government support. With its position as the world's largest flour exporter, Turkey continues to adapt and thrive in a competitive market, aiming to surpass 4 million tons of flour exports in 2024. These achievements are a testament to the country’s ability to harness its agricultural strengths and its flour production capabilities.

Within this thriving industry, Eflani Flour Mills continues to contribute significantly. As a family-owned business with decades of experience, Eflani produces a wide range of premium flour products, from all-purpose and bread flours to specialized varieties like pita and baklava flours. Eflani's commitment to quality and innovation reflects the broader trends shaping Turkey’s flour production and export success.