Letters of Credit: A Key to Safe Commerce

A Letter of Credit is a financial document issued by a bank that guarantees a buyer’s payment to a seller will be made on time and for the correct amount, enhancing trust and security in international trade. By providing a guarantee of payment, letters of credit make transactions between buyers and sellers more secure and smooth, overcoming challenges such as distance, differing legal regulations, and lack of familiarity between the parties. When a letter of credit is issued, the bank promises to pay the seller on behalf of the buyer, who must demonstrate their creditworthiness. This payment method involves banks making payments to the seller, typically requiring the buyer to provide proof of sufficient assets or credit lines. As negotiable instruments, letters of credit also allow the seller’s bank or any other nominated bank to make the payment, further facilitating secure and efficient trade transactions.

What Are the Types of Letters of Credit?

Letters of credit are structured to meet the specific needs of trade and the parties involved. Here is a brief overview of the different types:

1. Commercial Letter of Credit

A commercial letter of credit involves direct payment from the bank to the seller. It is widely used in large-scale and international transactions to ensure the seller receives payment even if the buyer defaults.

2. Revolving Letter of Credit

This type of letter of credit allows for multiple payments over a set period, automatically renewing after each transaction. It is ideal for ongoing, regular shipments without needing separate credit for each.

3. Confirmed Letter of Credit

In a confirmed letter of credit, a second bank (usually the seller’s bank) adds its guarantee to the payment. This provides additional security, especially useful in regions with high economic or political risks.

4. Standby Letter of Credit

Functioning like an insurance policy, a standby letter of credit is used if a party fails to meet their obligations. It compensates the affected party, commonly used in project financing and large construction projects.

5. Transferable Letter of Credit

This allows the original beneficiary (seller) to transfer the credit to a secondary beneficiary. It is beneficial in transactions involving intermediaries who facilitate rather than directly supply goods.

6. Back-to-Back Letter of Credit

Used when intermediaries are involved, a back-to-back letter of credit consists of two separate letters of credit to facilitate transactions without the intermediary using their own funds.

7. Red Clause Letter of Credit

This type of letter of credit allows the seller to receive an advance payment before shipping the goods. It helps the seller manage cash flow and prepare for production or shipping.

8. Irrevocable Letter of Credit

Once issued, this letter of credit cannot be changed or canceled without the agreement of all parties involved, offering high security to the seller.

9. Sight Letter of Credit

Payment under a sight letter of credit is made immediately upon presentation of the required documents, ensuring prompt payment to the seller.

10. Deferred Payment Letter of Credit

Unlike a sight letter of credit, this allows payment to be made at a future date after goods delivery, offering flexibility to the buyer while still guaranteeing payment to the seller

Advantages and Disadvantages of Using Letters of Credit

Letters of credit offer significant advantages by providing security and payment guarantees in commercial transactions. However, there are also some disadvantages, such as costs and complexity.

Advantages of Letters of Credit

Payment Guarantee: Letters of credit secure payment for the seller in case the buyer defaults.

Increased Trust: They build trust between the buyer and the seller, encouraging international trade.

Risk Management: By clarifying the terms of trade, they reduce the likelihood of disputes between the parties.

Facilitation of Trade: Letters of credit make commercial transactions between different countries safer and more organized.

Customizable Terms: They can be tailored to meet the needs of the parties involved and adapted to the specific conditions of each trade.

Disadvantages of Letters of Credit

High Cost: Letters of credit are costly due to the services and guarantees provided by banks. Banks generally charge a fee based on a percentage of the amount guaranteed by the letter of credit.

Complex Procedures: The process of obtaining a letter of credit involves many documents and procedures, which can be time-consuming and complex.

Time-Consuming Process: Preparing, approving, and implementing a letter of credit usually takes a long time.

Lack of Flexibility: The terms of a letter of credit are clearly defined, making it difficult to adapt quickly to unexpected changes.

Risk of Errors in Documents: Any errors in the documents can lead to payment delays or disputes.

How to Apply for a Letter of Credit?

Applying for a letter of credit is typically a detailed process conducted through banks. Preparing the correct documents and following the appropriate procedures are crucial. It is important to carefully manage each stage of the process when applying for a letter of credit.

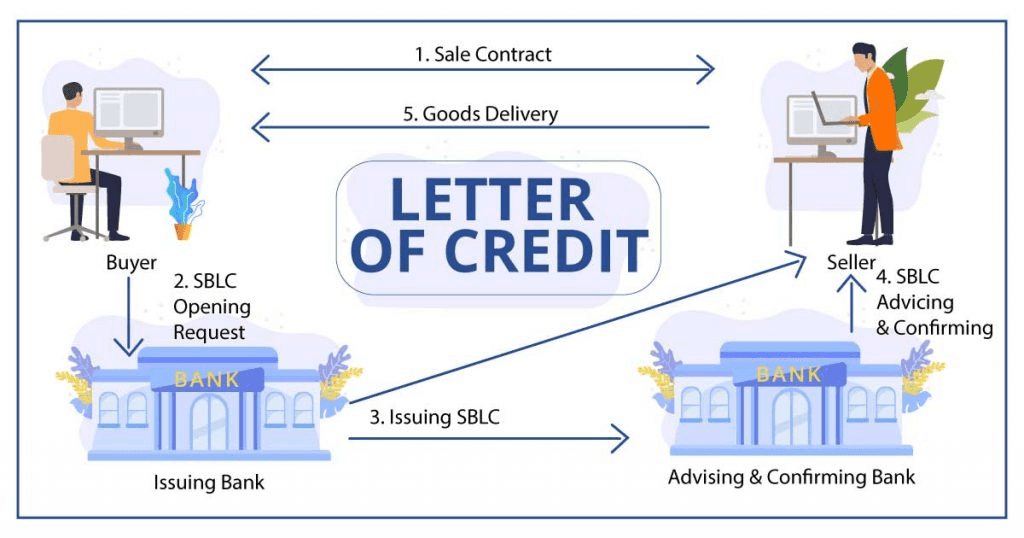

Stages of the Application Process

The first stage of applying for a letter of credit involves making a sales agreement between the buyer and the seller. This agreement forms the basis of the letter of credit to be submitted to the buyer's bank. The buyer applies to their bank following the terms of the agreement and submits the necessary documents. The bank evaluates the buyer's creditworthiness and then prepares the letter of credit, sending it to the seller's bank. The seller's bank reviews the terms of the letter of credit and informs the seller, and the transaction proceeds according to these terms. The seller ships the goods and submits the relevant documents to their bank. The bank reviews the documents to ensure they comply with the terms of the letter of credit, and then the payment transaction is completed.

The Role of Banks in the Application Process

Banks play a critical role in the letter of credit process. The issuing bank is the bank that issues the letter of credit and guarantees the buyer's payment. This bank evaluates the buyer's credit situation and payment ability. The advising bank is the seller’s bank, which reviews documents to protect the seller's rights. The seller's bank makes the payment after verifying that the goods have been shipped in accordance with the terms of the letter of credit. This cooperation between banks ensures that parties in international trade are secure and that transactions are completed smoothly.

Comparison of Letters of Credit with Other Payment Methods

Letters of credit offer a more reliable alternative compared to other payment methods, such as cash in advance and open account. They reduce the risk between parties while enhancing the security of commercial transactions.

Letters of Credit vs. Cash in Advance: In the cash-in-advance method, the buyer makes the full payment upfront, whereas letters of credit provide a payment guarantee by a bank. This ensures that the seller is guaranteed payment. Cash in advance generally provides immediate cash flow to the seller but may be riskier for the buyer.

Letters of Credit vs. Open Account: The open account method involves the buyer making payment after receiving the goods. Letters of credit, on the other hand, provide a bank guarantee during this process, ensuring that payment will be made. The open account may offer more favorable terms for the buyer but increases the payment risk for the seller.

Letters of Credit vs. Documentary Collection: The documentary collection method involves the seller submitting documents to the buyer, upon which payment is made. Letters of credit make this process more secure and organized. In documentary collection, the buyer must make the payment to receive the goods, which provides security for the seller.

Securing the Future of Global Trade

Letters of credit are an indispensable part of international trade, offering security to the parties involved. Choosing the right type of letter of credit ensures that trade is conducted smoothly and securely. Letters of credit not only build trust between buyers and sellers but also make commercial transactions organized and predictable. This financial tool facilitates secure global trade, contributing to economic growth and international cooperation.